The 3 Principles

We introduce ASSETPLUS’ investment philosophy and principle that will never change.

에셋플러스 리치투게더 펀드 출시

블랙먼데이를 바라보는 에셋플러스의 생각

인내의 끈을 놓쳐서는 안됩니다

New Normal; 중국 소비자, 모바일 디지털 네트워크, 그린에너지

New Normal; 중국 소비자, 모바일 디지털 네트워크, 그린에너지

New Normal; 중국 소비자, 모바일 디지털 네트워크, 그린에너지

2011년 또 다시 찾아온 블랙먼데이를 바라보며

5주년 기념 첫 운용성과보고 대회

에셋플러스 리치투게더 펀드 출시

블랙먼데이를 바라보는 에셋플러스의 생각

인내의 끈을 놓쳐서는 안됩니다

New Normal; 중국 소비자, 모바일 디지털 네트워크, 그린에너지

New Normal; 중국 소비자, 모바일 디지털 네트워크, 그린에너지

New Normal; 중국 소비자, 모바일 디지털 네트워크, 그린에너지

2011년 또 다시 찾아온 블랙먼데이를 바라보며

5주년 기념 첫 운용성과보고 대회

|

01

|

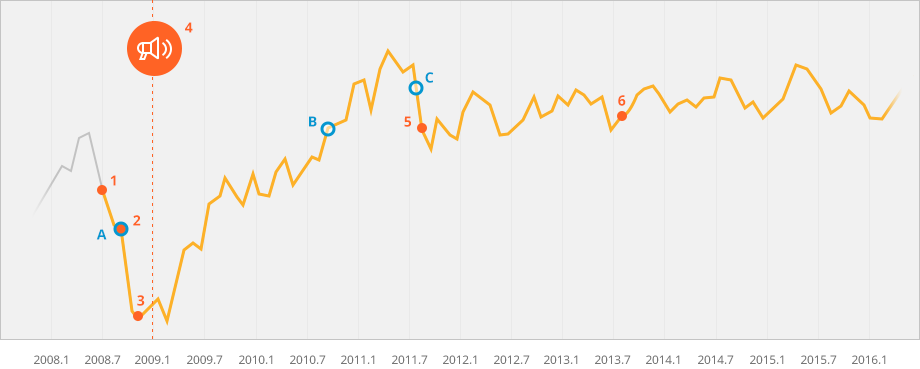

Commenced Sale of ASSETPLUS RichTogether Family of Funds In June, 2008, ASSETPLUS completed its legal transition to an asset management company from an investment advisory firm and |

|---|---|

|

A

|

The Bankruptcy of Lehman Brothers, Global Financial Crisis |

|

02

|

“ASSETPLUS on Black Monday” When all market participants were in fear, ASSETPLUS thought that it was our duty as an asset manager to actively approach investors. We placed a large advertisement in a renowned daily newspaper to deliver the message that they should remain in the market and not be gripped by fear. |

|

03

|

“Do Not Lose Patience.” Seeing mutual fund investors being gripped by fear and redeeming their shares en masse, Chairman Kang wrote a late night memo. |

|

B

|

Wrap Account - Craze |

|

C

|

U.S. Government’s Sovereign Credit - Rating Downgraded |

|

04

|

“New Normal” : Chinese Consumers, Mobile Digital Network, Green Energy ASSETPLUS pays attention to the changes around us. The firm seeks to identify and interpret value hidden within those changes before others, ultimately to translate those value into investment opportunities. The firm not only defined, but also promoted to investors the idea of a “New Normal” since 2009. |

|

05

|

“ASSETPLUS on Black Monday - Again” The US Government’s sovereign credit-rating was downgraded in 2011, bringing about another round of market turbulence. |

|

06

|

The Funds’ 5year Anniversary for Funds and Meeting with Clients on ASSETPLUS sought to always stay true to its guiding principles and communicate with its clients. In July, 2013, the firm was host to its clients’s meeting on fund performance, celebrating the funds’ 5year anniversary. |